Partner with Step Up For Students for Educational Opportunities

Become a Provider TodayJoin Us in Giving Students Educational Options

Step Up For Students works closely with private schools, public schools, educational service providers and educational product vendors to provide Florida PreK3-12 students with educational opportunities.

Find more information about becoming a partner as a:

Login if you are already a Step Up For Students Service Provider:

School and Provider Handbooks

School and Provider Handbooks were revised as of 7/1/2025.

Marketing Toolkit

Print Ready Flyers & Postcards

Bulletin Information

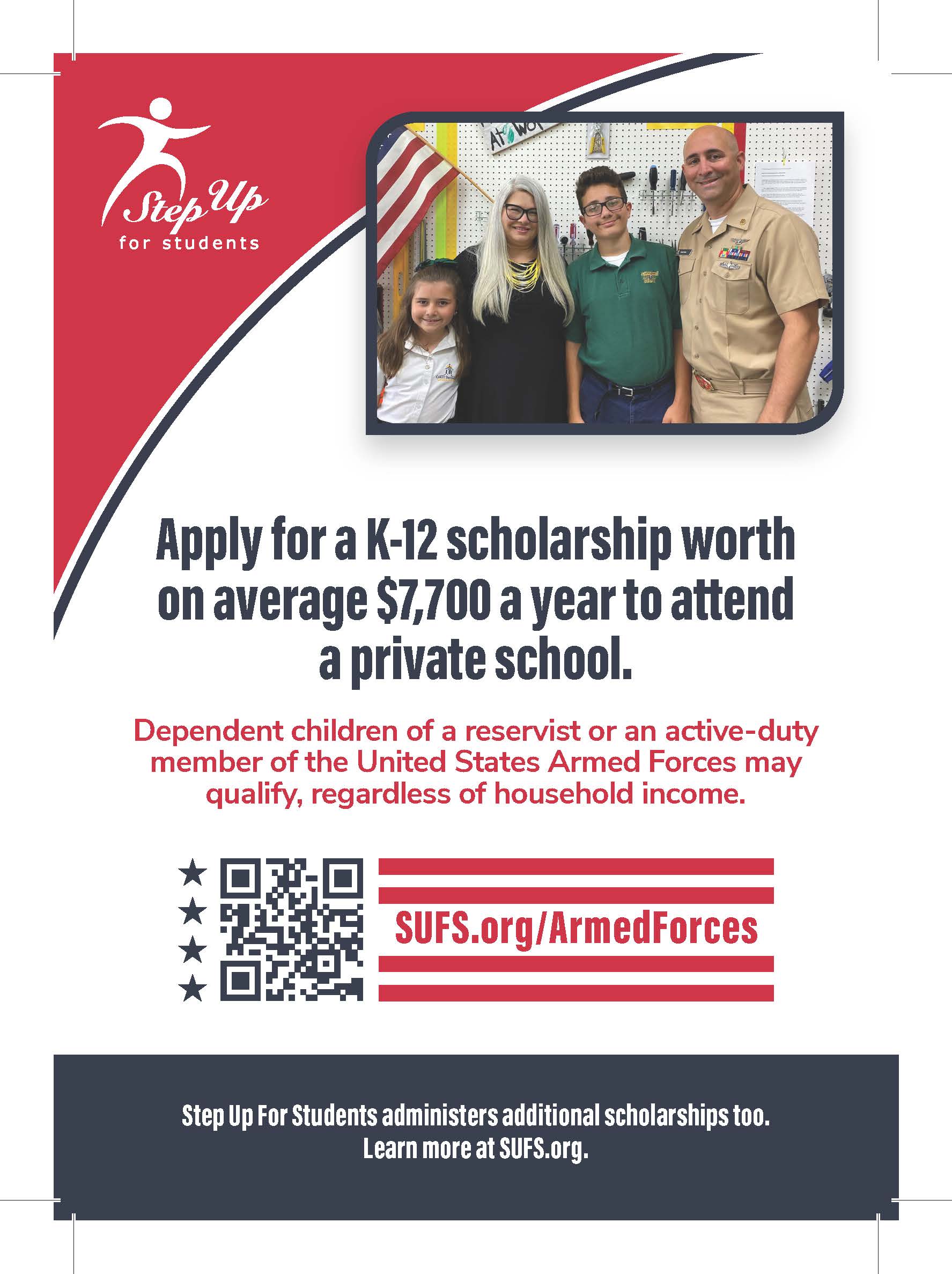

Your child could attend a private school with the help of a K-12 Step Up For Students Scholarship. Now all families are eligible, regardless of household income, to receive an average of $7,700 a year, per child for tuition and other educational needs. Child must be a Florida resident and eligible to enroll in a K-12 public school to receive a scholarship. Learn more or apply today at SUFS.org

Social Media Content

Social Media Content

Social Media Post Text for Private School Scholarship Programs

Share this on Facebook, Twitter and Instagram and tag us in the post with @StepUp4Students:

Family Empowerment Scholarship for Students with Unique Abilities

Share this on Facebook, Twitter and Instagram and tag us in the post with @StepUp4Students: