Workplace Giving Programs Support PreK3-12 Students

Make A Difference For A Student Today

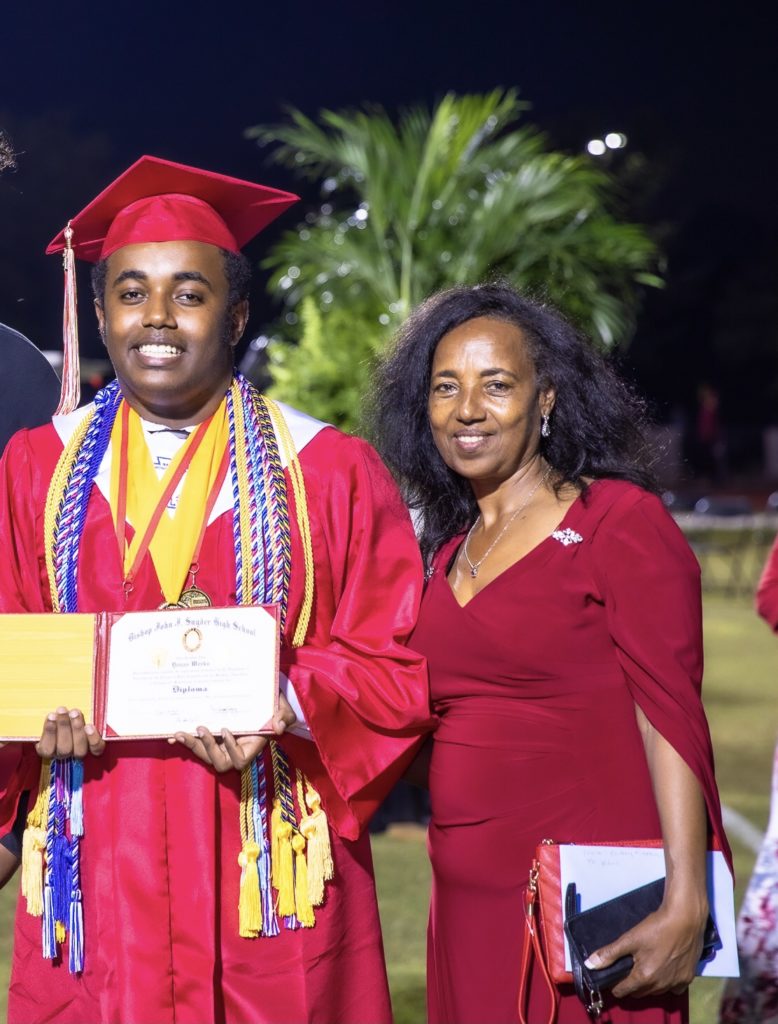

Your donation through a workplace giving program provides educational options for students. With your support, students can gain access to the customized education that allows them to thrive.

Does your employer match gifts?

Support Florida Students in the Workplace

You can help us maximize the impact of the scholarships through an employee giving campaign. With just a small deduction per paycheck, your employees can help fund programs that support Florida students in building a better future.

No employee giving program? No problem. Step Up For Students can assist your Human Resources and Payroll departments in setting up a deduction toward our vital programs.

Is Step Up For Students an approved charity for your employee giving program? If not, use our EIN – Employer Identification Number – (59-3649371) to add us to your list of approved charities.

Spread the Word. Some of your employees may benefit from one of our scholarship programs. By posting fliers in your breakrooms and including information about Step Up in your employee communications, you can help raise awareness about our scholarships. It’s that easy to empower your employees to find the best learning options for their children.